Trade Options For Consistent Income

Produce consistent income with options trading using various strategies and time frames, even through volatile markets.

My core strategy in the portfolio is a daily 0 DTE Synthetic Strangle Iron Condor. Here’s why…

0 DTE IC in SPX vs Market

Using the 0 DTE Iron Condor strategy results in higher returns than just relying on the market alone.

TAT utilizes the Interactive Brokers (IBKR) platform for trading, with future plans to extend to other brokerages. The software allows users to enter trade templates, schedules, and stop order management and execution. The stop order management is what allows me as a 0 DTE trader to use this software. Stop orders on spreads will automatically be converted to stop order on the short leg only when the long leg has no bid--no more worrying about spread stop orders not filling near the end of the day because of the long option.

SPX Trades Supported

0 DTE and other short term (1, 2, 5, 7 DTE, etc)

Credit Spread

Debit Spread

Iron Condor

Iron Fly

Double Calendar

Long Put/Call

Naked Shorts (Coming Soon)

Put/Call Calendars (Coming Soon)

Ratios (Coming Soon)

Trade Templates / Trade Selection

Target Min and Max Premium or Delta

Target multiple possible widths or certain cost for wings

Avoids overlapping long strikes with previous short entries

Multiple trade template criteria can be pre-defined

Multiple accounts supported

Trade Scheduling / Execution

Schedule multiple trade entries for automated execution

User defined fill progression (i.e. attempt to fill trade 3 times, lowering the limit price by 0.05 every 5 seconds)

Email notifications on order fills and stops

Stop Placement / Management

Stop can be placed on vertical spread or short leg only

User defined stop multiple

Stop order monitoring and replacement if a stop order is canceled for some reason

Automatic conversion from vertical to short leg only when the long leg has no bid

Scheduled conversion from vertical to short stops at user-defined time

Automated stop adjustments (i.e. move stop to breakeven after reaching 50% profit)

Profit target orders

Stop Limit / Stop Market OCO stops

Trailing Stop orders

Conditional REL order

Time of Day or Time in Trade scheduled exit

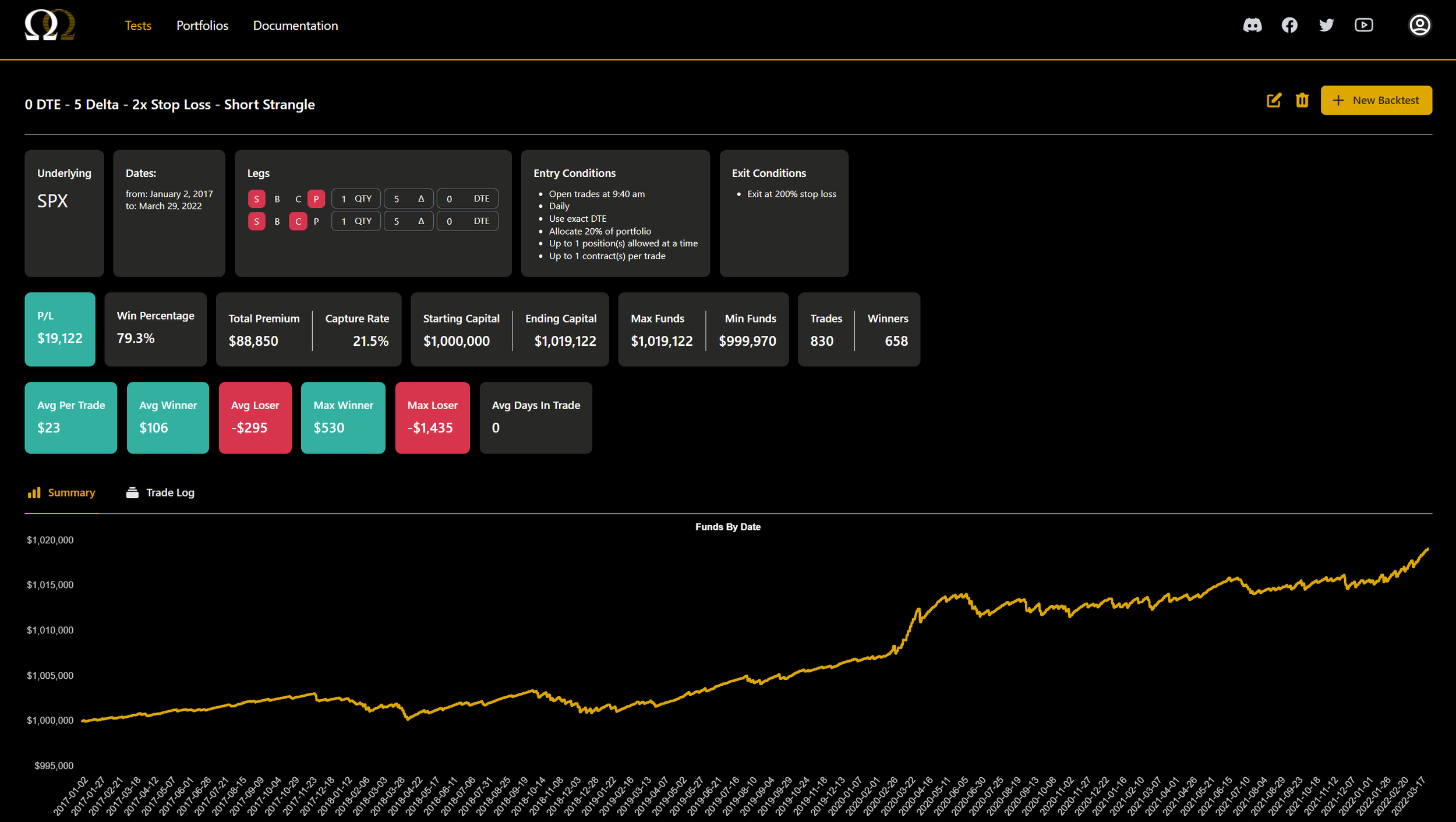

Backtest your Own 0 DTE Strategy

Use the best backtesting software for short term option strategies in the S&P and NASDAQ. Option Omega uses 1 minute data for backtesting which is a must for short term option strategies. The platform is sleek and is constantly being improved.

Check out my interview with a co-founder here:

https://www.youtube.com/watch?v=2HIQqtJha4o

Use my referral link to get 50% off for the first year:

https://optionomega.com/register/IncomeOptionsTrading

Don’t Trade Alone

Join our growing trading community to see my daily trades in near real-time, ask questions and learn from fellow traders. Signup as a Gold Member at our YouTube channel for access to our private Discord server.

Note: Link your YouTube account to Discord for access (User Settings —> Connections). Email us with questions.

Too Busy to Trade SPX?

I've spent a lot of time looking into different services and Trade Automation Toolbox (TAT) is the only service I found that allows trading SPX. TAT has hundreds of daily traders and active Discord community with the founder incorporating feedback into improving the service. TAT has been available since October of 2022.

You can use my link to get an extended free trial of 30 days for TAT--risk free and with no credit card required at signup.

You can see my daily trade log dating back to April 2021 in the link below, showing 1 contract per day. Some days were skipped for personal reasons and/or high expected impact events.

You can purchase my guide to the 0 DTE Synthetic Strangle Iron Condor strategy I run so you can also master the trade!

I have multiple video walkthrough’s of the 0 DTE Synthetic Strangle Iron Condor strategy on my YouTube channel. To see one of helpful videos, click the button below!

You can get a copy of my 0 DTE Trading Journal here: